(back to the Documentation)

The Belgian aviation market

The Belgian aviation sector is not a very well defined notion. It depends on the point of view of the analysis and can cover:

- the flight movements (landing and take-off) to and from Belgium and overflights,

- the number of Belgian licensed operators,

- the financial statistics of companies reporting their financial obligations in Belgium,

- etc.

1. Flight movements

1.1. Flight movements and activities at Belgian airports

As regards airports, the Belgian sector includes:

- one national airport (Brussels Airport) situated in the Flemish region (Zaventem) but depending on the federal government and in majority privately owned (70% of the shares belong to Macquarie Airports and 30% to the Belgian government);

- three regional airports in the Flemish region (Oostend-Bruges and Antwerp-Deurne as important regional airports and Ghent-Wevelgem as small regional business airport);

- two regional airports in the Walloon region (Liège-Bierset and Brussels South Charleroi).

According to Eurocontrol forecasts, growth figures in the Belgian sector are expected to range from at least 2,3% to as much 3,2% in the scenario with the highest growth expectations.

|

In 2006, the total number of passengers amounted to 19,5 million with Brussels National Airport counting for at least 85% and Brussels South Charleroi for more than 11%.

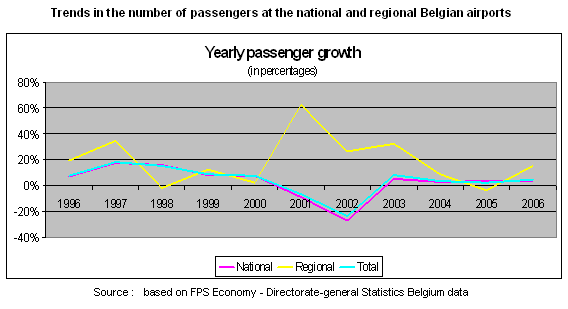

It is noticeable that regional airports have registered a strong growth in their passenger numbers just after the SABENA bankruptcy.

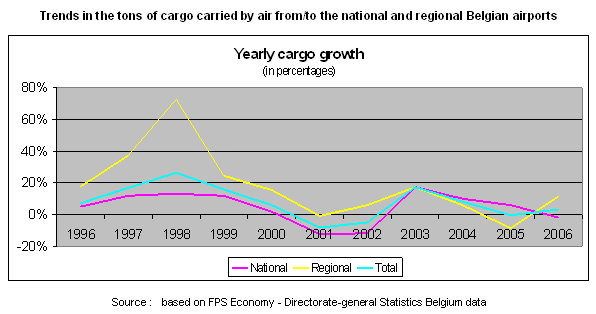

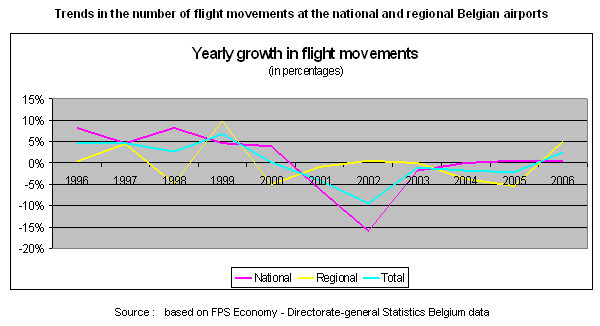

|

|

See also Flight statistics for more details.

1.2. Overflights above the Belgian territory

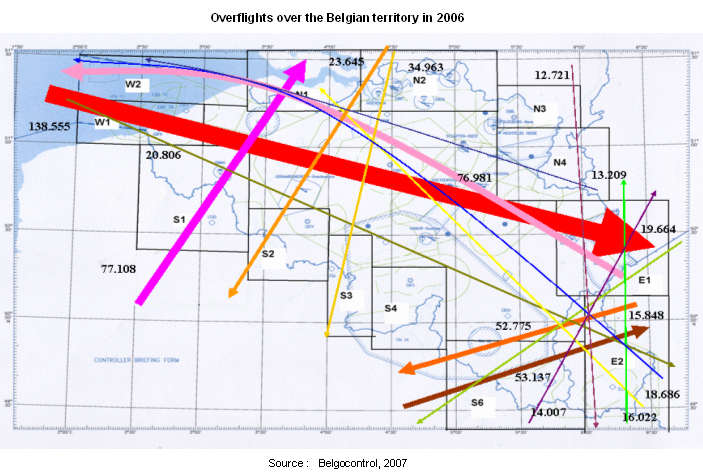

Beside the activity at the Belgian airports, the Belgian airspace is continuously crossed by aircrafts overflying the territory. In 2006, overflights above Belgium and Luxembourg amounted to 755.663 (1) , that is to say more or less 80% of the flights treated by Belgocontrol.

Those flights play an important a role for Belgium as regards climate impacts as a consequence of their emissions at high altitudes. This is mainly due to their regional or local climate effects (see Climate impacts of the aviation for more details).

Belgocontrol has depicted the main overflight routes above the country (see Figure hereafter) where it is clear that the dominant "flight corridor" is the west-east route.

|

2. Number of Belgian licensed operators

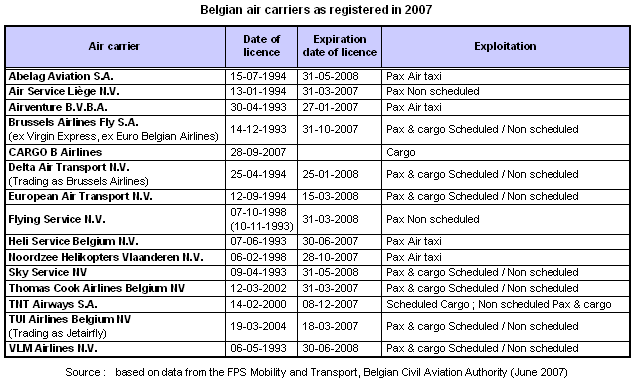

In june 2007, Belgium counted 15 national operators, among which two helicopter operators.

|

The total related fleet amounts to 173 aircrafts and helicopters, among which 20 have a MTOW lower than 5.700 kg.

Since October 2007, a new cargo operator has been registered in Belgium (Cargo B Airline) with only one aircraft.

3. Financial statistics

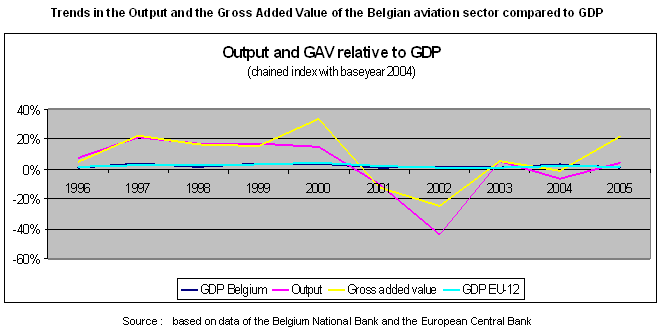

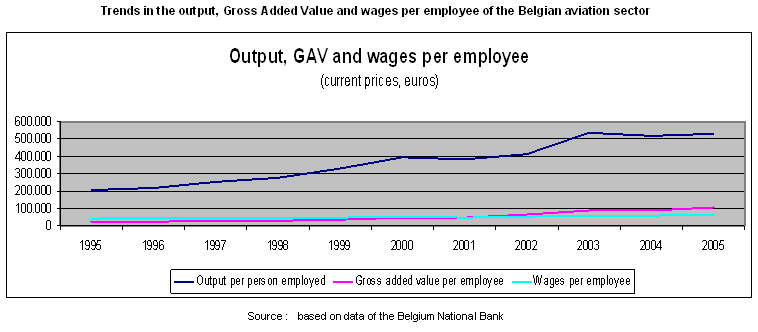

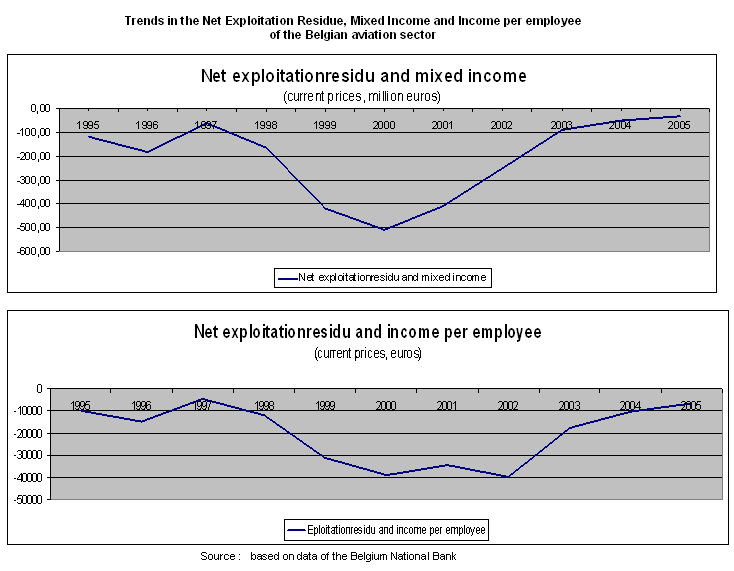

Concerning the financial aspects the sector reports a better efficiency and "profitability" after the 2000-2001 events.

|

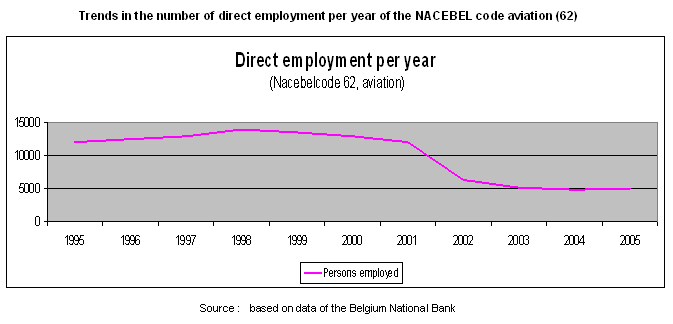

Employment in the Belgian aviation sector dropped heavily since the 2001-2002 events (bankruptcy of Sabena and 9/11 attacks) but it is important to note that the NACEBEL code aviation (62) is strictly limited to "what really flies". (2)

|

The Belgian aviation sector is specific because it has never been profitable as a whole during the last ten years which illustrates that margins are very low and that the sector is, at the moment, on one part still recovering from the 9/11 attacks, the SABENA bankruptcy, SARS and the DHL-debacle and on the other part is restructuring itself to become a profitable sector as is illustrated by the Figures hereafter.

|

"Profitability" of the sector is better in 2005 than in 2000 even with a lower number of passengers transported.

|